For years, American households have grappled with shrinking budgets as grocery costs climbed, gas prices surged, and rent demands escalated. Families who diligently saved faced mounting uncertainty about when relief might arrive. This week, that hope materialized—exceeding even the most optimistic projections. The data reveals a stark contrast to Washington’s persistent claims of economic stability.

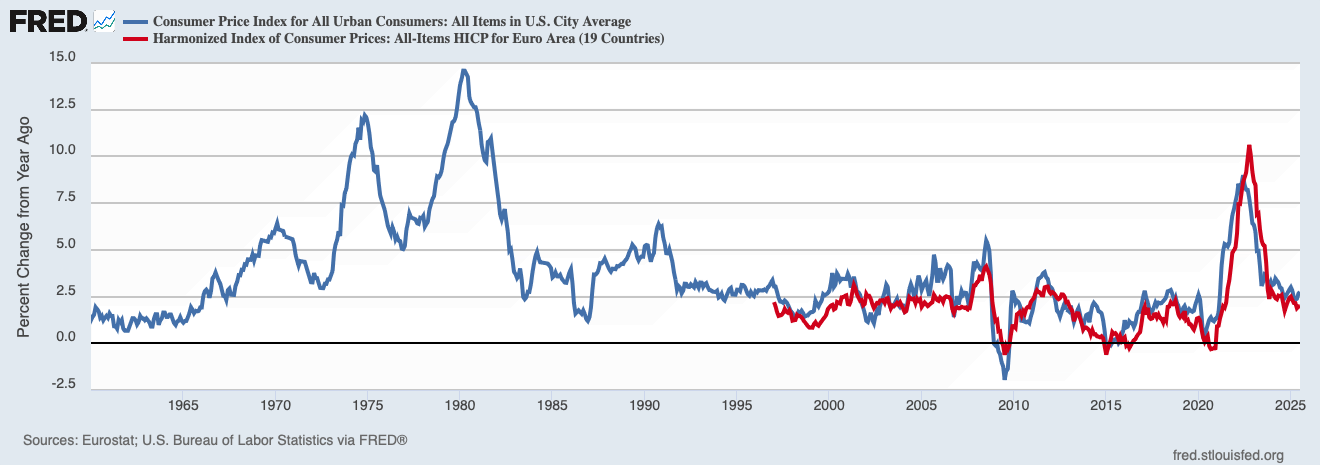

The U.S. consumer price index rose 2.7 percent annually in November, down from 3.0 percent in September and below economists’ forecast of 3.1 percent. Core inflation—the metric closely tracked by analysts—fell to 2.6 percent, the lowest level since early 2021. Shelter prices increased by just 0.2 percent, marking the slowest housing inflation pace in nearly five years. Grocery costs rose a mere 0.1 percent, the smallest monthly gain in months.

Economists surveyed by Econoday had predicted overall inflation would not fall below 2.9 percent; all forecasts were missed. Major appliance prices climbed just 1.2 percent, vehicle costs under one percent, and women’s clothing prices actually declined. The narrative that tariffs would trigger sharp price surges found no support in the data.

The trend extends beyond November. Market analysts anticipate sustained economic improvement for mainstream Americans, with middle-income households benefiting significantly from job growth, tax incentives, and stabilized inflation concerns. Federal Reserve officials have signaled potential rate cuts as bond markets reacted positively to the data.

Critics previously warned of severe consumer impacts from trade policies, but current metrics show heavily regulated categories experiencing minimal price pressure. This divergence between projections and reality has left opposition leaders without a credible narrative for 2026 economic conditions. The trajectory points toward tangible relief for households—without relying on political promises or speculative claims.